Ever look at a charge on your credit or debit card statement and wonder “who the heck is that?” We recently became aware of a lot of people finding a charge from “SEI” on their online statement who have no idea what SEI is, who SEI is, or what SEI stands for. They understandably want to know “What is this charge?” So we decided to write up this simple explanation of merchant names on credit card statements, using the cryptic “SEI” as an example.

It’s not surprising that with massive amounts of online financial transaction processing, and with more and more businesses being able to accept credit and debit cards more and more easily (think Square and Paypal), that lots of different merchant names and identifiers are showing up on banking and other financial statements, and that many of them are difficult to recognize, and hard to identify.

Every merchant who has a credit card processing account also has a unique Merchant Identifier (MID) number – and this is how they are known to the banks and credit card processors.

The name (which is different from the unique number) that shows up on your statement when they charge you is known as the ‘billing descriptor’ or ‘billed as descriptor’, and that billing descriptor is associated with their MID number.

Now, how the billing descriptor is assigned and then shows up on your statement (so, again, the ‘name’ that appears on your statement) is in large part, if not nearly entirely, a function of what the business puts on their application when applying for a merchant credit card processing account.

The Internet Patrol is completely free, and reader-supported. Your tips via CashApp, Venmo, or Paypal are appreciated! Receipts will come from ISIPP.

As Visa explains:

“The merchant name is the single most important factor in cardholder recognition of transactions. Therefore, it is critical that the merchant name, while reflecting the merchant’s “Doing Business As” (DBA) name, also be clearly identifiable to the cardholder. This can minimize copy requests resulting from unrecognizable merchant descriptors.

Merchant applications typically list the merchant name as the merchant DBA. This may differ from the legal name (which can represent the corporate owner or parent company), and may differ from the owner’s name which, for sole proprietorships, may reflect the business owner.

Keep in mind that the purpose of the merchant name is to identify the merchant to the cardholder.

Work with your acquirer to ensure your name is clear and discernible to cardholders when they read their statement.”

In addition, best practices dictate that a business use a billing descriptor that makes as clear as possible who they are, if only to minimize chargebacks that occur when a customer calls their bank and challenges a charge because they don’t recognize it. In fact, many providers of credit card merchant accounts emphasize this very thing. As [destination content has been removed at other end :~( ] explains:

“When consumers open their credit card statement at the end of a billing month, many of them scan the descriptions of the charges to ensure everything they are paying for is something they truly bought.

For ecommerce merchants, the descriptor they use to identify the charge is of paramount importance because a consumer can’t always connect a product he received in the mail with the line item in his credit credit card statement. This confusion can lead to the initiation of a chargeback. In many cases, the consumer indeed made the purchase, but sincerely does not recognize the charge on the bill. Hence, a carefully chosen billing descriptor could be a merchant’s solution to reduce such chargebacks.”

If the merchant has many locations, such a a chain, the merchant identifier may be different from location to location, depending on which region or franchise set up the given merchant account.

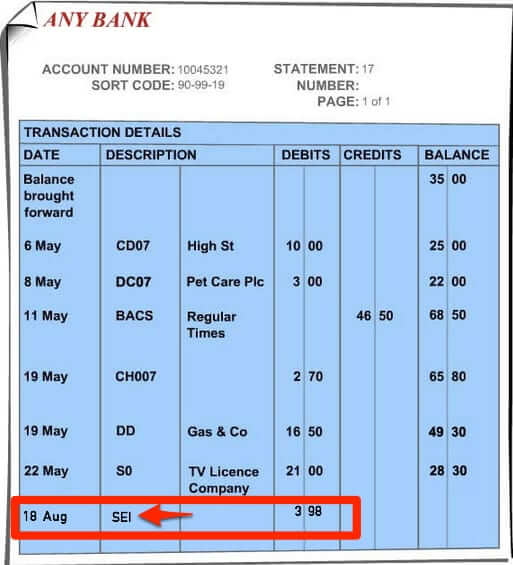

Such is the case with the merchant “SEI” – which actually stands for “Seven Eleven Inc.”.

Here, for example, are two different entries on the very same bank statement, from two different 7/11 locations just a few miles from each other:

SEI on Bank Statement

Seven Eleven on Same Bank Statement

And if that’s not enough, the whole thing is compounded by the new breed of online merchant account processing such as, again, Square and Paypal, as transactions from many businesses which use Square or Paypal to do their processing may show up simply as ‘Square’ or ‘Paypal’ – and you may not even be aware that that’s who the business is processing your card through (see, for example, our article Are You Showing a Mystery Charge from 402-935-7733 via Paypal, which has been found by more than a half-million people trying to figure out why Paypal is showing up on their credit card statement).

Unfortunately, there is no list of billing descriptors to cross-reference with company names, no doubt in part because it would be impossible to maintain, and in part because while on its own it might not pose a security risk, if it could be paired with other information it might.

But at least now you have a better working knowledge of that section of your credit card statement – and what SEI stands for.

The Internet Patrol is completely free, and reader-supported. Your tips via CashApp, Venmo, or Paypal are appreciated! Receipts will come from ISIPP.

YSI arium altamonte sprin and SP social cheat sheet, who are they? I didn’t authorize them to take any money off my card, the YSI took 125.00 and the SP took 20.00, does anyone know who these companies are? Please HELP!!!

There is a line item on my bank statement that I can’t identify.

” wfo04044 TYPE: WEB PMTS ID: 9000407646 CO: wfo04044 NAME: Charge: $451.37 Trans date: 04/27/23″ Can you identify this merchant?

Hello, we are not able to identify merchants generally, you would need to ask your bank, or determine with whom you spent that amount. We’re sorry!

Has Anyone ever had the Merchant on your Credit/Debit card statement be: NNT SCHROCK ENTERPR

there would be several numbers that would follow at the end, after the “R”

I don’t know, what the charges are from and I have several charges once a week. No contact information is provided with my financial institution.

What is YSI 3rd Generation Group

Is this a legitimate lender?

CHECKCARD SQ *HANDCRAFTED C is another one that has popped up recently… I’m assuming it’s a SQUARE CARD or charge, but it’s $5.57 and I have no idea who it is. Anyone have this merchant? I’d love to find out who it is! #Thieves

I made a purchase through a Home Depot Clearance ad that popped up last night. I used the PayPal option for payment. When I looked at my credit card, it showed the purchase processing as “PayPal *CEN RUIJUN”. Who is that? I thought I purchased through Home Depot??? I went back and looked at the final purchase (in my online cart) and noticed at the top of the page that it had the words “Waysflow – KR sponsored” still with the Home Depot logo. I am confused??? Have not yet received an email confirmation of the purchase with a tracking number. Wondering if this was a scam?

I have been Ill for a while and just going over this years Bank Statements. There is a Charge:

January 14, 2021. $20.00

48837 PP*FACE-BOOKPAY

Theb 4029357733

I have no idea what this is and I have

purchased no books.

Another Charge is:

November 28, 2021. $94.90

PREAUTH

HAPPY PLACE WORKSHOP W

8555183505 NJ

09312759

731032

I purchased Nothing on this date in fact

I never left my home.

I have not purchased anything through Facebook for over 2yrs.

I checked my PayPal Account and there

is no charges for these two amounts.

Please help!

I don’t have Google pay account set up yet. But there was charged $129.24 to buy Google Pro trial then take my PayPal account money charged to Google pay ID xxx6875 , and PayPal take a money from my debit card.

I claim Google with unauthorized charged but Google denied because found nothing? I check my Google play history stil not see showing of $129.24 charged. I do not know how to do? Just closed my PayPal account because it’s protect my account nothing.

I’ve been charged by a merchant “ ULTIMATEINDOPHYSQTESTO “ a charge of $ 89.97, but I have no idea what it is that I’ve been charged for nor do I have any idea who this merchant is? There is no telephone number given under the charge nor a description of the product

I have contacted CHIME, which is the card that has the charge but was told that the charge was rejected due to insufficient funds. I was also told that initially there was a S&H fee of $ 4.95 and that there is a 14 day trial period which ended yesterday. Since Chime rejected the $ 89.97, the $ 4.95 is still in my CHIME acct. Since the S&H is still in my account and the $ 89.97 was rejected by CHIME, am I still bound to the subscription. I also do not recall receiving any product under this merchants name. Can you help me with this?

But I have charges listed as 7-11 and Im sure my purchace amount wasn’t excactly the same 3 times in a row.

Yes what is CHK9

“Unfortunately, there is no list of billing descriptors to cross-reference with company names, no doubt in part because it would be impossible to maintain, and in part because while on its own it might not pose a security risk, if it could be paired with other information it might.”

Stupid answer: then how do they use it?

can you tell me who is drifted classic is?

What is WC *MON HO, 10900 Wayzata, STE. what is this charge on debit card.

What is dcs? I have a charge from gswgldcs.com

Thank you so much I was feeling scared as I could not remember where I would have spent this money. Heart started beating again.

Seven Eleven, Inc.

who is Deckerscons?

Use cash it is more simple, While we are talking about simple why do i have to cut an address i can barely see, open a new tab then paste the address and wait for it to load instead of just opening it as I used to?